The pandemic provoked a tangible shift in the air freight business, leading to significantly more aircraft now being converted to operate cargo services, as Bernie Baldwin reports.

Covid-19 brought about some of the fastest changes in the patterns of human behaviour in living memory. A notable example relates to our relationship with money, where the previously gradual transition to a cashless society was suddenly super-charged – to the extent that even the donations at many church services are now made by card to avoid handling physical cash.

At the height of the pandemic, only essential shops were open in many countries, resulting in a demonstrable switch from in-person to online shopping. The internet, of course, instantly shifted buying options from local to global, creating a considerable increase in the number of small- and medium-sized packages moving over long distances, both domestically and internationally.

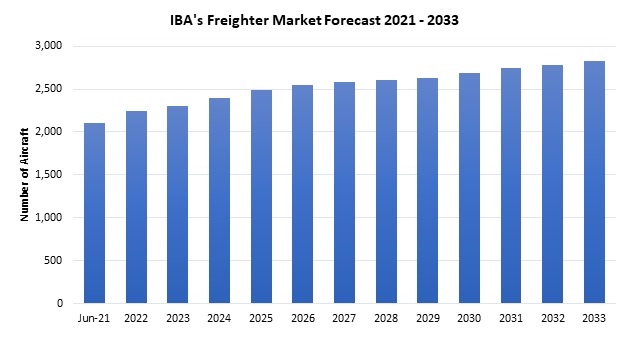

Such was the demand that some airlines were carrying packages on the seats of their passenger aircraft, while others actually converted some to full freighter configurations. Jon Whaley, senior aviation analyst at renowned consultancy IBA, has been looking at how the previously forecast demand has changed as a result of all this, and how much more cargo capacity will be needed to accommodate these new buying patterns.

“Current trends indicate that the growth in e-commerce appears to show little slowing down. Even as many nations emerge from the pandemic and associated restrictions, we are still seeing strong growth,” Whaley observes. “However, one needs to be careful to assume that such strong growth will continue, as many individuals will still be wary of returning to bricks and mortar, so there is still an element of uncertainty with regards to how exactly buying patterns will look in detail post-pandemic. It is safe to say, however, that the growth in e-commerce we were witnessing before the pandemic has been expedited since, and therefore freighter forecasts have had to be adjusted to account for this.”

Chart: IBA FREIGHTER MARKET FORECAST 2021-33, credit: IBA

With an ethos of maximising the life and value of aircraft, engines and parts, Luxemberg-based Vallair is already in the business of passenger-to-freighter (P2F) conversion. Currently it offers conversions of Airbus A321, Boeing 737 Classics and ATR 72-200/500s. Post-conversion, the aircraft are either leased or sold, often with an optional extra – one of Vallair’s own tailor-made MRO support programmes

The company’s director of trading and leasing, Patrick Leopold, believes the supply and demand equation has been slightly out of balance ever since the onset of the pandemic. “Generally, it is a good time for cargo as worldwide supply chain issues, together with a lack of shipping space availability, have led to a comparative cost advantage for air freight over shipping,” he notes.

“Low inventory-to-sales ratios mean that cargo capacity is utilised to satisfy demand for products in a timely manner. The resulting lack of available capacity drives up yields and revenues for cargo airlines,” Leopold adds. “Uncertainty remains over the impact of cargo with regards to the war in Ukraine and the related sanctions and airspace bans for Russian airlines in Europe and vice versa, but this is likely to put more strain on cargo capacity in the short term. In the long term it is expected that an increased level of cargo capacity will be sustained. This includes the change in buying patterns towards more e-commerce as well as the above mentioned factors.”

Avensis Aviation has P2F design and certification expertise for aircraft such as the Airbus A300-B4/-600, A330, A340 and Boeing 777-300, 747-400 and 767-200/-300. Its CEO, Cristian Sutter, has also been assessing the new demand scenario.

“Pre-pandemic, there was a 4% annual average traffic growth, measured in tonne-kilometres. However, express air freight was doubling in size every four years, fuelled by the e-commerce boom. This fast growth rate increased further as lockdown restrictions boosted online sales to unprecedented levels,” Sutter confirms.

“A combination of the slow recovery of the belly cargo sector, linked to languishing passenger demand, and a steep rise in the e-commerce sector’s demand for express cargo, is making the shortage of air freight capacity even more evident,” he explains, reflecting on a 20% increase in demand compared with pre-pandemic levels.

“The biggest influencing factor, post-pandemic, is now the current crisis in Ukraine. Airspace bans are resulting in longer flight paths for key e-commerce routes between Asia and the West. This is being exacerbated by increased fuel prices, and reductions in cargo capacity due to aircraft grounded by restrictions on Russian carriers, and damage to infrastructure affecting ACMI cargo airlines in Ukraine,” Sutter comments. “It is early days to predict the impact this conflict will have on the air cargo sector. But, in the immediate term, capacity has been reduced and operational costs have increased.”

Structural changes

Converting a passenger aircraft to a full freighter or even a quick-change type, whereby seats can be removed and pallets put in on the main deck, is not a simple task, as Vallair’s Leopold reports. “Conversions require a lot of work and knowhow, not only around the technical aspects of the aircraft but also around topics such as material management and supply chain logistics, supplier, and customer management. Having solutions in place that can support each of those areas during a conversion is crucial to manage the conversion budget and timelines,” he emphasises.

“Certification is usually a subject for the respective conversion houses as they will need certification to be obtained from FAA (US) and EASA (EU) initially, and for each CAA around the world subsequently. Such a process includes, but is not limited to, an in-depth review of the aircraft, its structure, the engineering procedures, methodologies and so on in accordance with the current regulations by the respective authorities,” Leopold continues. “There are different processes involved for each of these authorities and it requires a long lead time for an FAA or EASA certification to be completed. Local certifications are then generally based on certifications issued by these two key jurisdictions. Certification is therefore a main driver for the ‘saleability’ of a converted aircraft.”

P2F conversions are usually carried out on aircraft entering the final phase of their operational life, with the aim of getting the most out of the airframe. Consequently, those wanting to add them their fleet need to choose types that are cost-efficient to convert.

“Each aircraft type is different when it comes to conversions,” Leopold acknowledges. “However, in the narrowbody space, we see two main types emerging which are the 737-800 of the Boeing NG family and the Airbus A321 which is up and coming, and due to replace the Boeing 757 over the next decade.

“In the widebody space, the Boeing 777, 767, 747 are key players together with the Airbus A330-300 and-200 series which have entered the cargo space recently. Generally, it is market demand, feedstock pricing, availability and conversion slot availability that dictate the overall economics and drive to convert an aircraft,” the Vallair executive remarks.

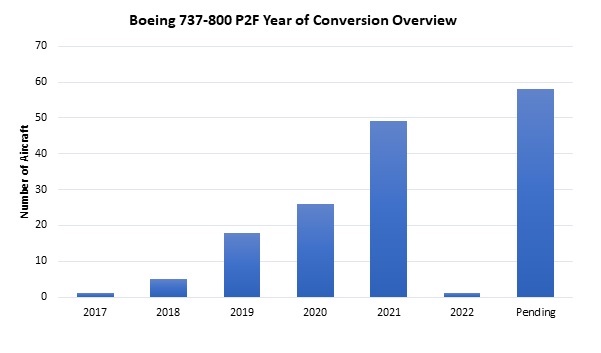

While IBA’s Whaley generally agrees, he hones in on two types in particular. “In terms of aircraft which are currently popular to convert, it is difficult to look past the Boeing 737-800 and 767-300ER. The 737-800 conversion rate has been impressive to say the least, with the number already converted exceeding 100 aircraft and at least a further 58 confirmed aircraft awaiting conversion or in the process of being converted,” he reports.

Chart: BOEING 737 CONVERSION OVERVIEW credit: IBA’s InsightIQ

“While the Boeing 767-300ER continues to prove to be a popular choice for P2F conversions, the feedstock is now starting to become rather limited, with 2024 expected to be the year when feedstock becomes critical. So far, over 150 767-300ERs have been converted, while an additional 40 are pending or currently being converted,” the IBA analyst adds.

“Both the Airbus A321-200 and A330-300 are set to be popular types for converting into freighters as we progress through the 2020s. The A321-200 programmes have only recently started converting aircraft, with seven examples in service and 23 aircraft pending conversion, while the A330-300 is entering that value range where a greater amount of feedstock now makes economic sense for P2F conversion and this is being reflected in an expanding backlog,” says Whaley.

If proof were needed that cargo operations – particularly the express package sector – will most likely continue to grow, Embraer has recently announced the launch of the E190F and E195F passenger-to-freighter conversions. According to Arjan Meijer, president and CEO of Embraer Commercial Aviation, the new converted freighters are “perfectly positioned to fill the gap in the freighter market between turboprops and larger narrowbody jets”. Entry into service is expected in early 2024 and Embraer forecasts a market of around 700 of the type over the next 20 years.

With the ongoing shifts in the freight landscape, this type of segmentation will become more prevalent and further P2F programmes are likely in the coming years. Sometimes, there’s no going back.

Author: Bernie Baldwin

Published: 31st March 2022

Feature Image: Courtesy of Embraer