Being an independent MRO subsidiary of a carrier has its perks, such as a guaranteed stream of maintenance work and associated revenue from the parent company, and the ability for the MRO company to seek new business opportunities and partnerships. Beyond this base, many are expanding their client base beyond the airline with which they might share a brand, both to boost revenue and to create resilience — real benefits in the grip of a pandemic.

That’s definitely the case for Indonesia’s GMF AeroAsia, which struck out on a new path in 2002 after being spun off as a strategic business unit of Garuda Indonesia. Independence has since enabled it to diversify beyond commercial aviation into the defence maintenance and power services businesses, reduce its reliance on Garuda for revenue, and form strategic partnerships with peers like Air France Industries KLM Engineering & Maintenance, aimed at enhancing its quality systems and maintenance capabilities.

Such improvements and business diversification require — and are driven by — the use of digital tools and new technology. Rian Fajar Isnaeni, GMF’s spokesperson and vice-president for corporate secretary and legal, tells us that the use of tools with the latest technology has enabled GMF to automate manual-based work or replace existing applications used.

Building on early digitalisation efforts like enterprise resource planning tools — several internally-developed applications were created and synchronised using these platforms. This resulted in the ability to better maintain the airworthiness and reliability of the serviced equipment, develop closer relationships with customers, drive employee empowerment, further digitalise its operations, and commercialise the technology GMF had created.

There are challenges however, such as the need to navigate through a new change management process. To overcome this, GMF held familiarisation workshops for the various tools, implemented mandatory training for users, and provided rectification support should a problem occur.

As for the impact of COVID-19 on the company, GMF’s Rian says measures meant to stem the spread of the coronavirus, including travel restrictions, resulted in capacity reductions and reduced aircraft utilisation by carriers worldwide. Parent Garuda Indonesia, which was put into a court-supervised debt restructuring in December 2021 amidst financial troubles of its own, ad to reduce its fleet size, leading to a reduced amount of maintenance work sent to the MRO company.

The IT master plan that had been developed to meet its long-term needs, based on a five-year work plan, needed to be adjusted “to mitigate the impact of the COVID-19 pandemic,” Rian explains.

To overcome the pandemic’s impact, GMF is pursuing strategies centred on conserving cash, diversifying its business, and developing new strategic partnerships. On partnerships, Rian cites memorandums of understanding signed in the second half of 2021: maintenance cooperation with an Indonesian pilot training school potential construction of a hangar on Sulawesi island’s Makassar airport with operator Angkasa Pura I; and collaboration opportunities with industrial equipment MRO provider Sulzer.

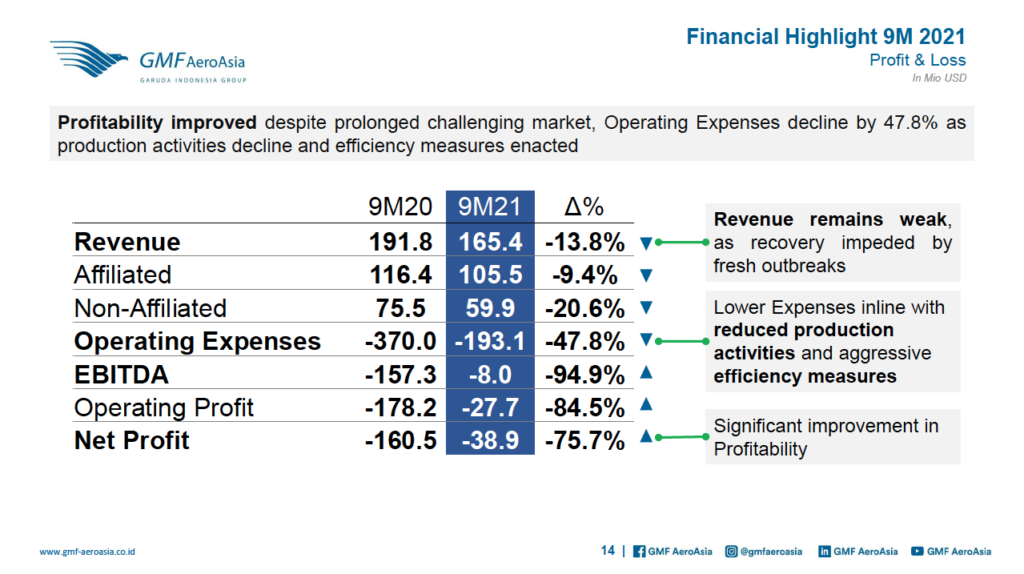

Based on an investor document provided by the company detailing its performance in the first nine months of 2021, the number of airframe, engine, and component maintenance works conducted all fell on a quarter-on-quarter basis. The decline was also reflected in its financial results, although GMF managed to narrow its losses.

GMFI PERFORMANCE & STRATEGY Q3 20121 9Dec 2021

GMFI Performance & Strategy Q3 2021 Chart of page 14 from the full PDF

But within the document, it also indicated GMF’s business diversification plans — aiming to offset losses and establish new revenue streams — which include providing services such as cabin disinfection, maintenance checks prior to aircraft preservation and long-term parking, aircraft redeliveries, cargo conversions, and those related to business aviation.

As for the defence business, GMF is developing capabilities to maintain helicopters, the engines of Lockheed C-130H military transport, and the CASA C-212 turboprop’s airframe. This builds on a contract GMF and Collins Aerospace won to modernise the C-130H cockpit operated by the Indonesian Air Force.

Despite uncertainties caused by the pandemic, Rian says GMF remains interested in business expansion, although this will be done with partners, through joint partnerships, investments, or resource-sharing schemes, so as to reduce risk and exposure.

But he adds agreements signed in recent years, such as the joint venture pact with Batam Aero Technic, the MRO arm of Lion Air Group (and a rival of Garuda Indonesia), are now under review.

Although Indonesia’s launch of a mass vaccination programme against COVID-19 at the start of 2021 led to hopes of an economic recovery and growing demand for air travel, Rian believes “there will be challenges and uncertainties moving forward,” as governments worldwide have remained cautious in easing travel restrictions, “in a bid to keep the COVID-19 transmission levels as low as possible.”

“While many parts of the world are experiencing new waves of COVID-19 infections, the progressive rollout of COVID-19 vaccines offers hope of a gradual recovery of the aviation industry and the MRO business,” adds Rian.

Author: Firdaus Hashim

Published: 15th March 2022

Feature photo by Fasyah Halim on Unsplash