One of the key concepts in the decarbonisation of aviation is calculating scope 3 greenhouse gas emissions within the supply chain — and how to account for them. But what are those emissions, and what are the carbon accounting considerations that need to be considered? Join us for the latest in the series of our ab initio introductory guides.

Carbon accounting is, at its base, a framework methodology to calculate how much greenhouse gas an organisation emits across its entire value chain. Within aviation, this means categorising those emissions into scopes 1, 2 and 3, each of which must then be calculated.

One of the more complicated — and therefore instructive — elements of the aviation supply chain to consider during these calculations is the cabin interior, so we sat down with Elina Kopola and Daniel Clucas from the Green Cabin Alliance, an industry working group aiming to reduce the environmental impact of this expensive and interconnected part of the aircraft.

“Scope 1, scope 2, and scope 3 are all individual categories of greenhouse gas emissions,” Kopola tells us. “Scope 1 is under your organisational direct control: it might be about the fuel you use, it’s directly what links into your factory or office, regardless of the size of your organisation. Scope 2 is then a little further in: it’s the fuel that your vehicles would use, for instance. Then scope 3 is your supply chain, up and down from where you sit — regardless of whether you are a supplier or an end user. If you’re a brand, it might be your emissions that are generated from your supply chain, and your suppliers.”

More specifically, she says, “if you’re an airline, it will be the OEMs [original equipment manufacturers], seat manufacturers, and so ons. But it’s also your customers, it’s the emissions that your customers are creating: getting to the airport, and, of course, taking the flight. There, you have very little control.”

Carbon accounting is certainly complex, but standards are coalescing. At the same time, multiple environmentally focussed jurisdictions — think California and the European Union in particular — are developing regulations requiring scope 3 emissions to be calculated and reported.

“At the moment, as an organisation you are obliged to declare your scope 1 and your scope 2, but your scope 3 does not have to be declared,” Kopola notes. “But it will become a regulatory requirement soon enough.”

As with much of the work needed to make aviation more sustainable, early work will reap rewards with compound interest, both in terms of internal expertise and professional experience and in terms of an understanding of what’s needed by customers and partners.

On the customer side, Kopola says, early work around “you’re educating the consumer to look for those things, and that’s good: it’s a driver for all of us to get used to talking about it, measuring it, considering it, and most important thinking about how we can impact it.”

Fundamentally, she explains, “a very simple way of thinking about it is that, you know, if you can control your scope 1, and your scope 2, and you’re reducing it and recording it, that already impacts everybody else’s scope 3. So you are tackling scope 3 [for industry partners] if you tackle your own scope 1 and scope 2.”

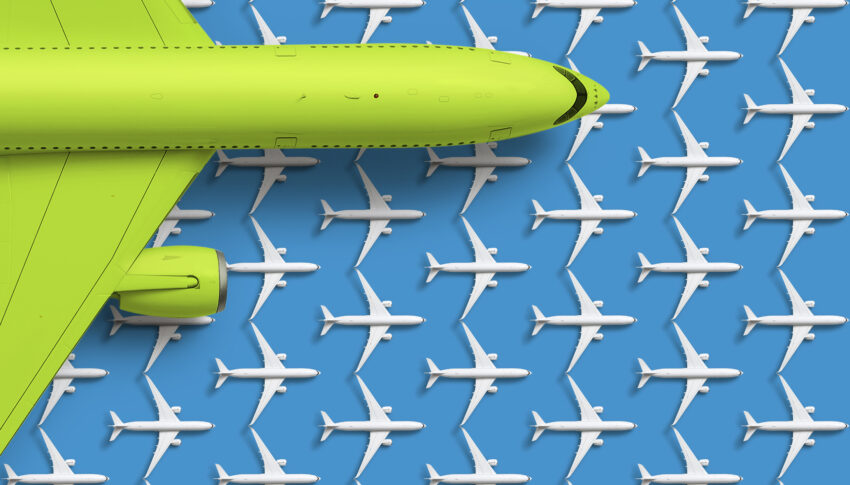

Aviation’s elaborate and international supply chains mean that scope 3 emissions likely to be complicated to calculate

As an inherently global industry, with large multinational companies that are in many cases built to span borders, the need to get to grips with scope 3 is vital — since some part of production is likely to fall within a jurisdiction that will require reporting by the end of this decade.

“Airlines are complicated companies, right?” Clucas asks, wryly. “They own many things. They provide services with the things they own. The things they own have things from other people in. There are so many suppliers airlines work with: the OEMs, everyone that creates the cabins, the engines, all their airport operations, they have so many elements to their business. They’re not just picking an apple and selling it.”

Indeed, returning to the interiors market as just one example, the cabin is the second most expensive part of the total airframe package after the engines.

For an airline, says Clucas, “every single company that they work with each has their scope 1s, 2s and 3s. Those contribute to the airline’s scope 3s — and sometimes their 1s and 2s. Getting far enough down the chain to work out, for their scope 3… to get from that manufacturer all of their data, to go right back to their suppliers, and that supplier, where do they get all their raw materials from — you’re chasing down so many different levels.”

It’s often highly customised and, given its relatively low volumes compared with a sector like automotive, almost all complex elements are usually hand assembled in small factories dotted in small manufacturing towns around the world, then sent on to airliner final assembly lines for linefit or maintenance hangars for retrofit.

Notably, he highlights, “because there is no mandatory reporting of this, there are ways to calculate scope 3, but there’s not a way — there are many different ways you can calculate it. So there’s a lot of margin for error, by the time you get back down, to make sure you haven’t double counted or missed anything.”

This calculation work will be particularly important to meet obligations under the European Union’s Corporate Sustainability Reporting Directive and similar requirements.

To meet this challenge, carbon accounting tools are being developed “in the same way as company accounting or financial accounting has been fairly revolutionised in the last ten years or so by digital tools,” Clucas says, explaining that the experience of that industrial element involved “taking the established way of reporting and digitising it. We don’t even have really the established way of reporting or measuring yet in this world of emissions. At least that can go hand in hand with the digital transformation, and the two can work together.”

Author: John Walton

Published: 04 January 2024