Data released by the International Air Transport Association (IATA) has demonstrated that global air passenger traffic saw a downturn in February due to a combination of international travel restrictions and a seasonal slump in demand.

This has defied expectations that commercial operations will benefit from a linear recovery in 2021 and demonstrates that the aviation industry remains highly sensitive to new regulatory changes in light of revised epidemiological advice. Whilst the lull in February is expected to represent a low point in capacity and demand as the global situation improves over the coming months, industry stakeholders should nevertheless consider that it may also be indicative of a longer-term trend as seasonal contractions become the ‘new normal’. This could ultimately result in a more complex global regulatory environment that features a high degree of both geographic and temporal variation based on hemispheric alternations during the winter months.

Global Overview

Comparisons between data sets for 2019, 2020 and 2021 have revealed that in February revenue passenger kilometre (RPK) levels decreased by 74.7% year-on-year. Whilst this is not unexpected due to the contrast between pre- and post- pandemic periods, the data has also revealed a month-on-month decrease between January and February across all regions, which equates to the worst short-term growth outcome since July 2020.

Meanwhile, total domestic demand in February was also down 51% compared to pre-pandemic levels. This represents another downward turn from the preceding month when the figure was 47.8% lower than 2019. This has largely been attributed to a reduction in activity in China where the national authorities urged citizens to avoid travel during the Spring Festival holiday period. According to IATA’s newly-appointed director general, Willie Walsh, all indicators appear to show a lack of improvement for the industry as a whole over the winter months. However, he has also noted that partial recoveries in some smaller markets like Australia have demonstrated that the public have not lost their desire to travel, and that “they will fly, provided they can do so without facing quarantine measures”.

Regional Breakdown

Figure 1: Percentage changes are calculated between 2021 and 2019 to provide a ‘normal’ point of comparison.

Air Cargo

In contrast to this decline in international passenger numbers and operating capacity, the air cargo industry has seen significant growth over the same period according to IATA data. Analysis seems to suggest that demand for air freight has now out-performed pre-pandemic levels. Overall, global cargo tonne-kilometres (CTKs) were up 9% compared to February 2019, as well as an additional 1.5% compared to January 2021. This has meant that total volumes have returned to levels seen prior to the US-China trade dispute in 2018. The trend is unsurprising given the importance of air freight in the carriage of medical supplies and considering that most national governments have exempted cargo operators from their flight bans.

Short-Term Impact

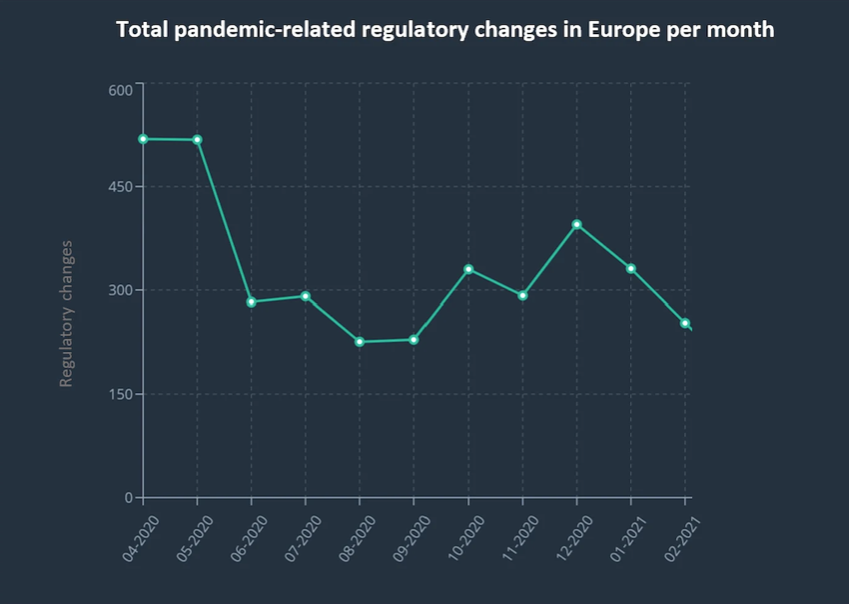

Over a year since most nations first shut their international borders in response to the proliferation of COVID-19 infections across the world, most regions are still struggling to contain second- and third-wave epidemics as the pandemic continues to have an unprecedented impact on international politics, economic development and social freedom. Whilst the development and rollout of effective vaccines have provided a definitive exit strategy, the recent proliferation of new viral variants has slowed, and in some cases reversed, progress towards resuming international air travel on a significant scale. The graph below is illustrative of the uptick in regulatory amendments that occurred at the end of 2020 as national governments in Europe and elsewhere sought to isolate their populations from threats posed by new variants of concern (VOCs). In most cases, these measures have persisted throughout the first quarter of 2021 and were a significant contributing factor to the February lull in capacity and demand.

The aviation industry remains highly sensitive to the imposition of these restrictions which, in most cases, are still stunting growth in demand for flights between formerly co-dependent nations, economic partners and blocs. The downward trend in demand and capacity in February has defied earlier expectations that the industry would undergo a linear recovery in 2021 as unforeseen regulatory changes have been made in light of revised epidemiological advice.

The lull in February is expected to represent a low point in both capacity and demand as the global situation improves over the coming months due to seasonal changes, the proliferation of bilateral travel agreements, and the continued rollout of COVID-19 vaccines among the populations of key markets in Europe, Asia and North America. Notably, the US Centers for Disease Control and Prevention (CDC) has recently amended its advice on domestic travel and has stated that vaccinated individuals are at “low risk” of COVID-19 infection, following a review of efficacy data and the risks associated with different methods of transportation. Under the revised advice, vaccinated individuals do not need a polymerase chain reaction (PCR) or any other form of diagnostic test upon arrival at their destination and should not be required to observe a mandatory quarantine period when traveling domestically. This is expected to provide a significant boost to demand for domestic services.

Meanwhile, the development and implementation of ‘immunity passport’ schemes is also expected to facilitate the resumption of international flights as individuals who have either received a COVID-19 vaccine or have recently recovered from the disease are permitted to travel. Indeed, many major airlines have already begun to trial app-based verification systems like IATA’s ‘Travel Pass’ and Daon’s ‘Verifly’ document to simplify this process. The European Union also plans to launch its own ‘digital green certificate’ service over the next three months. According to the president of the European Commission, Ursula von der Leyen, this will create a “gateway for interoperability between nations” in the Schengen Area free-travel zone, whilst also creating a blueprint for similar systems to be used by other international unions.

Long-Term Impact

The aviation industry is used to experiencing fluctuations in demand at certain points in the calendar year due to major events, public holidays and other market forces. Stakeholders are therefore accustomed to having to carefully manage resources and schedules to account for these dynamics. However, operators may now also have to adjust their modelling to take into account epidemiological patterns as seasonal changes in COVID-19 infection rates and associated fatalities precipitate an annual drop in demand during the winter. This may also be compounded by regulatory changes as national authorities impose temporary restrictions and/or seek to discourage the public from travelling to locations where the virus is prevalent.

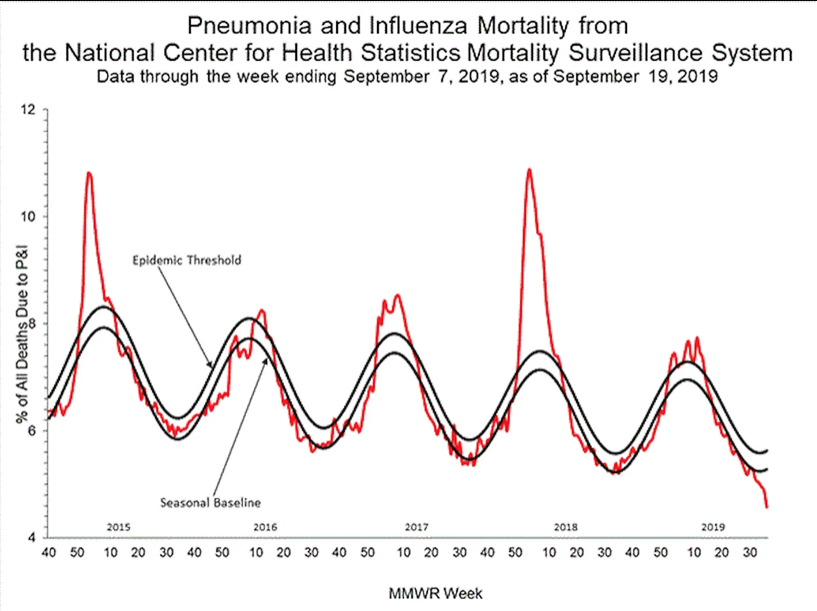

Several epidemiologists have suggested that as the worldwide vaccine rollout gathers pace, outbreaks of COVID-19 may fall into a pattern of hemisphere alternation. Like many other globally prevalent viruses, of which influenza is a commonly cited example (see graph below), SARS-CoV-2 is likely to propagate more readily during the coldest months of the year. It will therefore be more prevalent in the northern hemisphere from December through to March, and between June and August in the southern hemisphere. However, unlike flu, COVID-19 is deadly enough to continue to warrant the use of active measures to control its spread, which could ultimately result in a more complex global regulatory environment that features a high degree of both geographic and temporal variation.

Figure 3: Graph to demonstrate seasonal fluctuations in influenza infections in the US. Source: US CDC

It remains very difficult to predict what the global operating environment will look like over the next few years largely due to the recent proliferation of new VOCs, which threaten to reduce vaccine efficacy rates and prolong the implementation of travel restrictions. Unfortunately for the aviation industry, most national governments have learnt the hard way that preventing new strains from entering a country by limiting international arrivals is ultimately less costly than having to deal with a subsequent epidemic wave. It is therefore likely that the detection of a new VOC in a particular location, either through local genetic surveillance or the testing of samples submitted by travellers, will initiate a wave of travel restrictions as other countries seek to limit its spread.

Whilst the widespread distribution of COVID-19 vaccines has already started to have a significant positive impact, it may be years before jabs, as well as boosters that protect against new viral strains, are regularly available in all global regions. The SARS-CoV-2 virus will therefore continue to circulate among these populations, particularly during the peak winter season. With this in mind, it is important to consider that the lull in capacity and demand witnessed in February 2021 may have set a trend, which persists over subsequent years. At the very least, this episode serves as a warning against predictions of linear growth, and that unforeseen fluctuations in demand will have to be accounted for in post-pandemic contingency planning.

Author: Thomas Finney

Aviation Security Analyst, Osprey Flight Solutions

Published: 18th May 2021

To find out more about Osprey Flight Solutions take a look at their Yocova profile.

Strengthen your risk management culture and register for the free service – Osprey: Open – via the Yocova marketplace.