With commercial and cargo aviation market outlook forecasts at the Dubai Airshow this week, Airbus and Embraer are both bullish about the future of aviation, with both predicting a return to pre-COVID levels of activity by 2024.

Overall, the European OEM expects global air traffic, as measured by revenue passenger kilometres, to return to 2019 levels sometime between the beginning of 2023 to the end of 2024. Assessing that the COVID-19 impact on world real GDP is approximately a two-year lag, Airbus suggests that “GDP remains the fundamental long term driver for traffic growth”, and that air traffic will experience a similar two-year lag.

Comparing the 2021 market forecasts with their pre-COVID 2019 equivalents the positive wider picture is notable, as is the growing importance of the Chinese market, which Airbus now splits out separately from Asia-Pacific and where it sees substantial growth. These two regions alone account for nearly half of the forecast deliveries over the next twenty years.

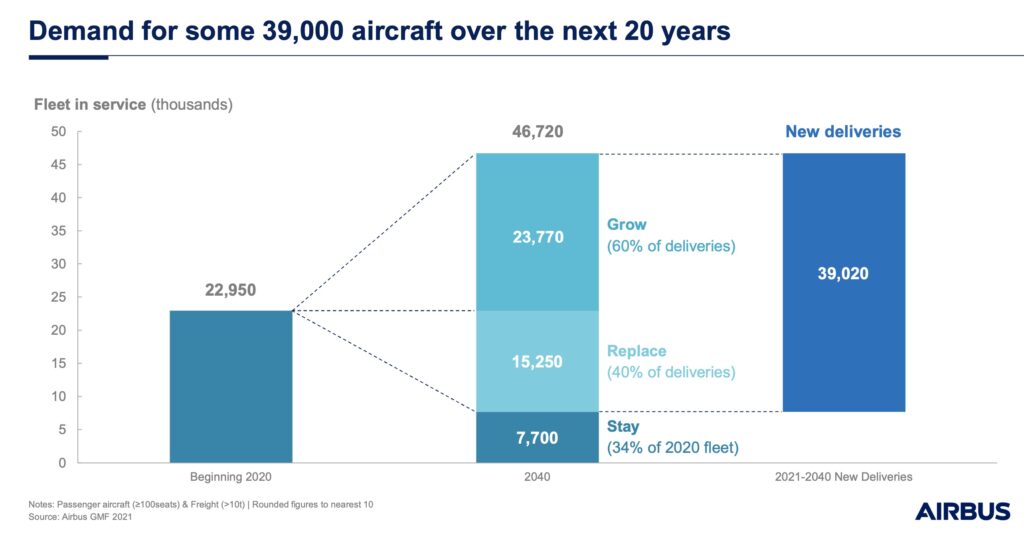

Airbus assesses a need for some 39,000 new aircraft above 100 seats between now and 2040, of which roughly 60% will be growth and 40% replacements. A further 7,700 aircraft already in the air today, it estimates, will continue to serve passengers in that time period: some sixteen percent of the present fleet.

Airbus sees growth as a significantly stronger driver in its categories. Image courtesy of Airbus

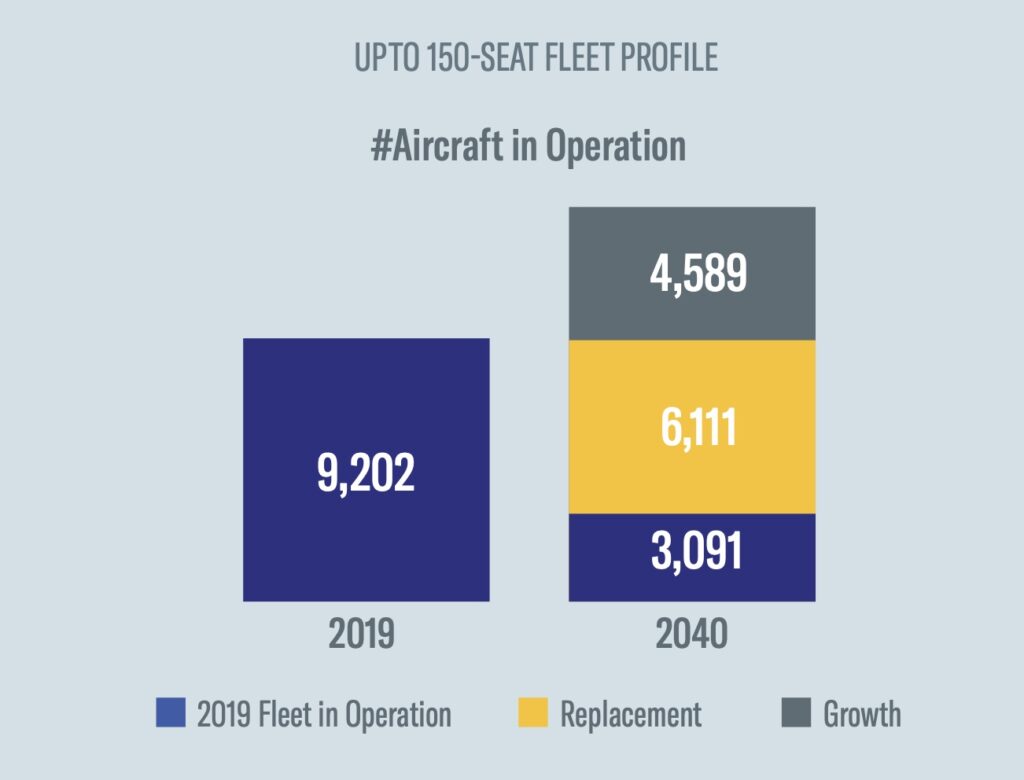

Regional jet airframer Embraer [PDF] is predicting demand for 10,900 aircraft in the under-150-seat category (which doesn’t map directly onto Airbus 100-seat-plus numbers). Here, too, Embraer expects roughly a 60:40 split — but in the other direction to Airbus, between growth and replacement aircraft, respectively.

Embraer predicts replacement as the stronger driver. Image courtesy of Embraer

These aircraft may well be the last generation of aircraft powered by kerosene, which will increasingly be sourced via more sustainable methods. Airbus’ primary development focus for future aircraft fuels is hydrogen, which it expects to commercialise towards the end of this forecasting period, most likely with aircraft on the smaller end of its size portfolio, but it took pains to emphasise that there is a role for more sustainable aviation fuels in the meantime — and potentially beyond.

“The world is expecting more sustainable flying and this will be made possible in the short-term by the introduction of [the] most modern airplanes,” explains Christian Scherer, Airbus’ chief commercial officer and Airbus’ International boss. “Powering these new, efficient aircraft with Sustainable Aviation Fuels (SAF) is the next big lever. We pride ourselves that all our aircraft — the A220, A320neo Family, the A330neo and the A350 — are already certified to fly with a blend of 50% SAF, set to rise to 100% by 2030 — before making ZEROe our next reality from 2035 onwards.”

Embraer, whose aircraft market seems set to be the ripest for alternative propulsion, whether electric, hydrogen, hybrid or otherwise, echoes Airbus’ environmental focus, with its report noting that “disruptive propulsion technologies are not yet available. They will likely be implemented on regional aircraft platforms before seeing wider applications on larger jets. Until then, the focus will be on using Sustainable Aviation Fuel (SAF) and improving operational efficiency.”

Replacement is increasing as a driver for aircraft requirements

“As economies and air transport mature, we see demand increasingly driven by replacement rather than growth[, r]eplacement being today’s most significant driver for decarbonisation,” explains Airbus chief commercial officer Christian Scherer.

Most of this demand — 76% or some 30,000 aircraft — is in the “small aircraft” category, like the A220 and smaller members of the A320neo family, with 14% for “medium” sized aircraft (5,340 aircraft like the A321XLR and A330neo), and 10% in the “large” category (the A350, nearly 4,000 aircraft).

Airbus splits deliveries into three categories. Image courtesy of Airbus

Geographically, Airbus splits the demand world up into eight regions, which are, in descending order of size together with their predicted demand:

- Asia-Pacific, 9,400 aircraft

- China, 8,220 aircraft

- Europe, 6,960 aircraft

- North America, 6,420 aircraft

- Middle East, 3,030 aircraft

- Latin America, 2,460 aircraft

- Africa, 1,100 aircraft

- CIS, 1,440 aircraft

It’s notable that China and Asia-Pacific make up nearly half the total figure.

Notable regional sub-splits in the forecast include a forecast of almost twice as many aircraft in the “large” category in the Middle East and Asia-Pacific as in North America, Europe or China: 1010 aircraft in the Middle East, 900 in Asia-Pacific, 660 in Europe, 590 in China and 520 in North America.

In the smaller aircraft category, Embraer splits this up into 8,640 jets and 2,260 turboprops, and splits the world into seven regions (including China within Asia Pacific), predicting delivery numbers of:

- North America, 2,710 jets, 430 turboprops

- Asia Pacific, 2,160 jets, 900 turboprops

- Europe, 1,770 jets, 430 turboprops

- Latin America, 760 jets, 180 turboprops

- CIS, 640 jets, 100 turboprops

- Middle East, 720 jets, 40 turboprops

- Africa, 280 jets, 180 turboprops

Within the Embraer numbers, turboprops are seen as a particularly strong

COVID-boosted freighters are a growing market

Moving on to the freighter market, Airbus predicts that there is a demand for some 2,980 additional freighters above 10 tons, of which roughly a third (950) are for growth — driven by the explosion in freighter operations accelerated by the COVID-19 crisis — with the rest (1490) being replacements, and a further 540 presently operating freighters remaining active.

This demand is split between small (A321-sized, 1000 airframes), and medium (A330-sized, 900 airframes), with 540 large (A350-sized) freighters required. Airbus currently markets factory-fresh medium and large freighters, but small freighters are aftermarket passenger-to-freighter conversions.

As an interesting aside on the growth side of the table, Airbus also highlights that the overall efficiency of the industry — this time measuring by revenue passenger kilometres per aircraft — has grown by 45% over the last twenty years. This growth is driven by a two-hour increase in daily utilisation from 8.5 hours to 10.6, an average of 18 more seats per flight (up from 161 to 179), and an increase in average load factor of 13%, moving from 69.8% to 82.5%.

Fundamentally, these forecasts tend to be a big-picture view into the future, but their basic consistency between the 2019 and 2021 versions — two-year lag notwithstanding — will be reassuring to many within the industry.

Author: John Walton

Published: 18th November 2021

Feature image: by Troy Mortier on Unsplash