From big data to substantial intelligence

by Bernie Baldwin

18-Mar-2021

Taking data from aircraft systems and creating intelligence for use by maintenance, flight ops and safety teams can improve operations and create cost efficiencies as well as being used for strategic planning. Following on from an earlier article, Cost-effective comms for the connected aircraft, Bernie Baldwin continues the journey from transmitted data to operational intelligence.

Much has been written about the amount of monitoring which goes on in modern aircraft. Thousands of parameters from an aircraft’s systems are tracked to check that those systems are performing correctly. Smart interrogation of that data though, is what provides intelligence to airlines, MRO providers and OEMs which can then be used to optimise future operations and drive business value.

Whether downloaded in real-time during the flight or retrieved post-flight, the processing of each data packet type presents a challenge. Philippe Lievin, integrated digital solutions marketing lead at Collins Aerospace, points out the need to manage specific data routing according to the message types. “For example, a message sent from the engines can be routed to the engine manufacturer, while position reports can be routed directly to the airlines OCC (Ops Centre),” he explains.

“Another challenge that the airlines are facing is the diversity of systems and applications they need to interface: from applications running on legacy mainframes to applications and services running in public clouds, such as Amazon Web Services or Microsoft Azure. In addition to the data routing, the Collins IMS GMP (ARINC Global Management Processor) delivers ACARS gateways able to convert aircraft data in real-time to be ‘ingested’ by this diversity of platforms and applications,” Lievin adds.

“As soon as data lands on the ground, the data manager can dispatch it to the different data consumers, so flight data goes to the safety team, data related to fuel goes to the fuel conservation team, data coming from the EFB (electronic flight bag) applications go to the Flight Ops/OCC Teams. Note that certain data can be provided to multiple stakeholders; for example, flight data can go to both the safety team and the platform running analytics programs like Collins Aerospace’s Ascentia,” Lievin elaborates.

Equally, data will be channelled to a long list of third-party applications running within the airline’s digital estate and across business functions such as flight operations, safety, maintenance etc.

Sorting data for targeted analysis

At Teledyne Controls, the company’s aircraft data solutions development director, Edgar Salvador, similarly reports that as soon as data arrives at a ground operations centre (on-site at the airline or on a cloud-based platform), it is separated and routed to its different stakeholders. “For us, routing the data is not only the distribution of it but also cleaning, filtering and redacting parameters and information so that each analytical solution receives only the parameters and information needed for their particular analysis,” he says.

“This allows users to comply with any internal regulation related to the use of the data. For example, members of the fuel team will not receive data related to precooler temperatures out of the engines and engineering teams working on ATA 36 components would not receive information related to the effect of flap deployment altitude has on the fuel consumption,” Salvador comments.

In the case of Teledyne Controls’ analytical solutions, the arrival of new data packages is monitored every single second. “Each analytical solution specialises in a specific type of data analysis such as flight safety, maintenance and engineering and operations and fuel analysis. This means that different sophisticated and specialised algorithms are applied to the data to be able to detect conditions related to each of these areas.

“The use of the our wireless GroundLink QAR (Quick Access Recorder) enables us – for example – to notify a maintenance and engineering user shortly after landing that a valve needs to be replaced and at the same time inform the operations team that extra fuel was consumed in the last flight,” states Salvador.

The SITA mindset on data

Pierre-Yves Bénain, portfolio head aircraft data management at SITA FOR AIRCRAFT, provides the reminder that when an organisation like his touches subject data, the mindset always has to be, ‘What for?’. It could be, for example, for an OEM, for which the answer would very likely be “For pro-active maintenance”.

To deal with this, Bénain continues, SITA FOR AIRCRAFT has launched a data hub – called e-Aircraft Datahub. “We take the data from the airlines and deliver it in a clean, structured and enriched way to be ingested by an OEM’s analytics. The one thing to note, is that we agree beforehand with the airline and the OEM about the transfer of data.

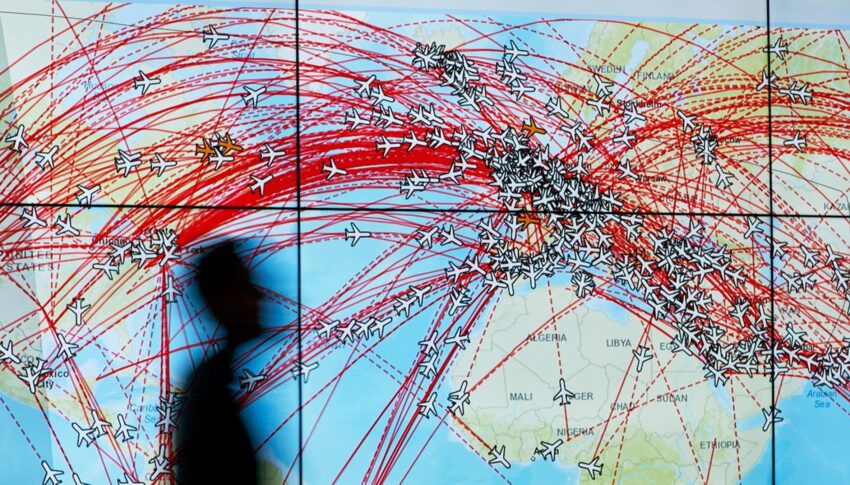

Image appears courtesy of SITA.

“At the end of the day the competition [in this area] is very much on what people do with the data,” he continues. “This is where we see different approaches. Some try to create new services – and we are using our platform for this – and some try to optimise costs. Because data is delivered for different purposes, you can create value or optimise your costs.”

Some companies even use the intelligence from all this data for their sales force. “They educate the sales teams about the behaviour of the product so they can create a pitch about the quality of the product,” Bénain explains.

Like Salvador, Bénain emphasises the need to ensure that the data is clean. “The world of aircraft data is far from being perfect. We see that what comes out of the aircraft is not seen the same way and sometimes you have two interpretations for the same event.

“Finally comes the ability to marry data to provide what the user needs. We are working, for instance, with a training company which is looking after the creation of a training database built on real flight data. So instead of creating an ‘artificial landing’, we can help them to replay the flight sequence and look after specific aspects, like the braking conditions on a wet runway,” he remarks.

Accessing the value of data

After the delivery of clean data, those interrogating it – airlines, MRO providers (in-house airline department or third-party supplier) and OEMs – need to employ appropriate apps which can produce usable intelligence for the development of strategy and planning across each part of the airline or new aircraft operational procedures.

“There is a huge diversity of applications,” Collins’ Lievin observes. “It is difficult to be exhaustive, but we can mention several key applications that can contribute to the maintenance activities.

“The technical logbook keeps track of any information related to the aircraft: aircraft condition, failures, maintenance ops and inspections. It is synchronised with the ground and its key data can be shared automatically between the stakeholders involved in the maintenance tasks (MRO, engineering, flight ops),” he remarks. “Meanwhile, analytics platforms such as Collins Ascentia will perform a deep analysis of the aircraft data and provide very relevant information enabling more proactive maintenance operations. Finally, there is a range of MRO software solutions to manage the maintenance and engineering tasks, as well as logistics needs in compliance with the regulatory requirements.”

SITA FOR AIRCRAFT has a portfolio of applications in the flight operations domain. “We don’t have any portfolio of maintenance apps because it’s very specific,” Bénain notes. “Of course we clean the data first using our own correctional algorithm and we say to the OEM, ‘Here is the raw data. Here is what we think it should mean when recorrected, and you can choose between the two’. It’s important that we leave the final choice to the OEM. This is done with the permission of the airline, of course.

“Then we expose in a format that can be the usual APIs or even from Messenger or so on. And we provide a dashboard about the activity – which airlines are still giving data, which aircraft are still generating or not generating and so on,” Bénain adds.

“As well as data transmitted during the flight like ACARS, there are the post-flight files downloaded from the aircraft after landing using the QAR. “Then you find, let’s say, somewhere between 10,000 and 40,000 parameters on those files which touch upon the route of the pilot, safety aspects of the flight and the maintenance aspects of the flight. Every user will find what they need in these files,” he confirms.

Effective analysis software is key

According to Teledyne’s Salvador, there are many applications that could be used for the analysis of flight data. “There are, however, a few qualities and features that must be present to ensure the effectiveness of the application,” he advises.

“First, it is important to consider an application that can process different type of data formats. Most of the applications out there can only ingest data with a friendly format such as .csv or .txt file which means that a different previous application has to prepare the data for them first,” he continues. “There are other solutions such as our analytical application AirFASE that can transcribe and convert flight recorded data from its original format to engineering units without the need to rely on any other application.

“It is also important to be able to use applications that can help solve problems or events that happened in recent flights and to solve and prevent issues that can only be identified by automatically analysing aggregated historical data,” Salvador stresses. “Finally any key analytical application has to provide the flexibility to expand the monitoring criteria as the levels of experience and the needs of the airline evolve.”

With data sets from aircraft likely to continue to grow, such attributes can only attract operators to such solutions for intelligence delivery. Additionally, however, the value of those data sets can realised further.

Using data to drive business performance

Each operator, of course, uses the data it needs to drive business performance. But as Collins’ Lievin notes above, the range of applications which could make use of these sets is huge; the aviation software market is highly fragmented and complex. It follows that the procurement and implementation process for applications can be an equally complex, high-risk-with-high-investment exercise in terms of reviewing, selecting and procuring the right solution for your operation. This is followed by the often-challenging task of implementation, encompassing data integration and data security, the user rollout (including training) and potential changes in the management process. These all create key challenges for every operator.

Data the owner uses for its own purposes may also have value for another operator, whether in raw form or after processing through an application. The potential to commercialise specific data sets is a trend which is gathering interest. Of course, the owner would preserve the value and intelligence it derives for itself from a data set by anonymising it before marketing and selling. The challenge here is to have the right medium for safe and secure data sharing and monetisation. Or in fact for pure data sharing and collaboration purposes.

On the other side of this equation, the opportunity for an airline to purchase and feed additional data into its existing applications to augment and enhance internal data sets can unlock yet further intelligence. The challenge then, is what data to sell, and what to buy and to do all that in a safe environment. The same principle of safely and securely enabling access to an operator’s data sets by supply chain partners, offers further upside potential.

The development of exchanges and marketplaces for such data and applications is happening now and these will assist operators in this selection, contracting, implementation and value unlocking process, which will be discussed further in a later article in this series.

Join the conversation

We’re talking about this in our challenges section – we’d love to hear your views. How do we unlock the value of big data and where do we find the best software applications to help us do so?