Smaller aircraft will always have a role to play the air transport industry. New types have been few and far between for some time though, but that is now changing, as Bernie Baldwin reports.

It’s the policy of the vast majority of countries to enable their populations to live away from big cities and towns. Overcrowded metropolises are not the be-all and end-all for many people in order to attain a certain quality of life.

To have more remote communities and keep them viable, good transport connections are an imperative. Within the global air transport system, that means operating ‘thin’ routes, with much lower traffic levels, so smaller aircraft are required. Obviously, there are also other areas served by thin routes, island nations such the Indonesia and the Philippines being an example.

The problem for those markets is that the number of sub-50 seat aircraft in the global fleet is diminishing, as Doug Kelly, senior vice-president – asset valuation at AVITAS, notes in his assessment the size of the market for such types over the next 10 years.

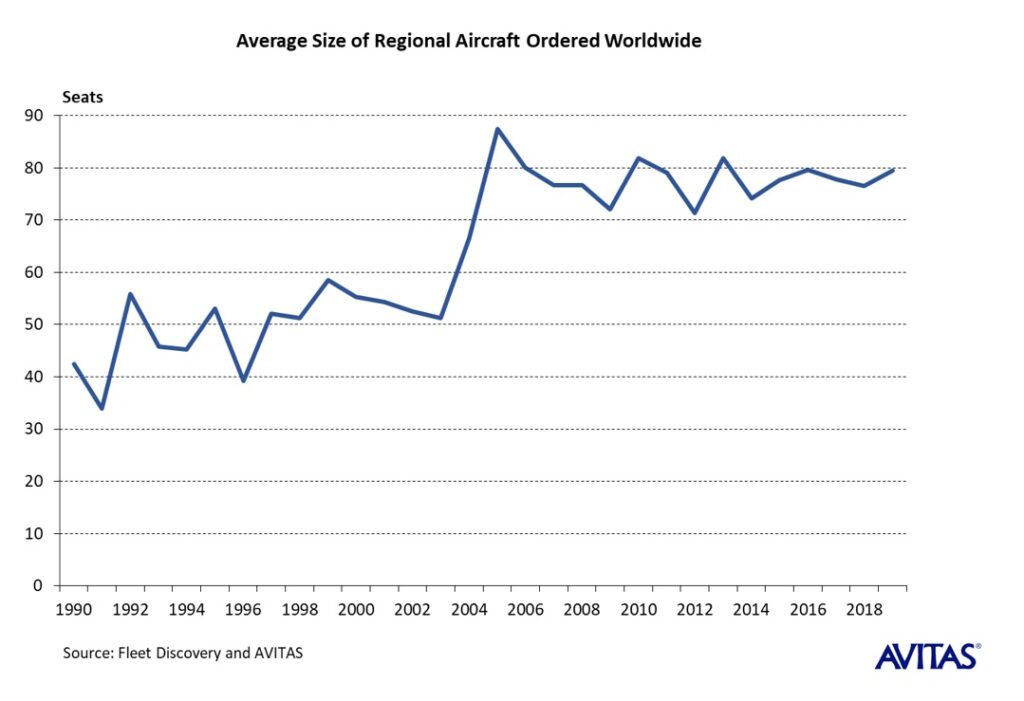

“The average size of regional aircraft ordered has been increasing from 40 seats in 1990 to 80 seats today (see Figure 1). This trend is due to the introduction of small jets at first and then, in the early 2000s, the bigger more capable types were introduced, such as the Embraer E-Jet family and the stretched derivative of the original CRJ from Bombardier,” Kelly reports. “Passenger preference for larger aircraft, high fuel prices and scope clause limits on size and weight all played a role in contributing to the trend to larger regional aircraft.

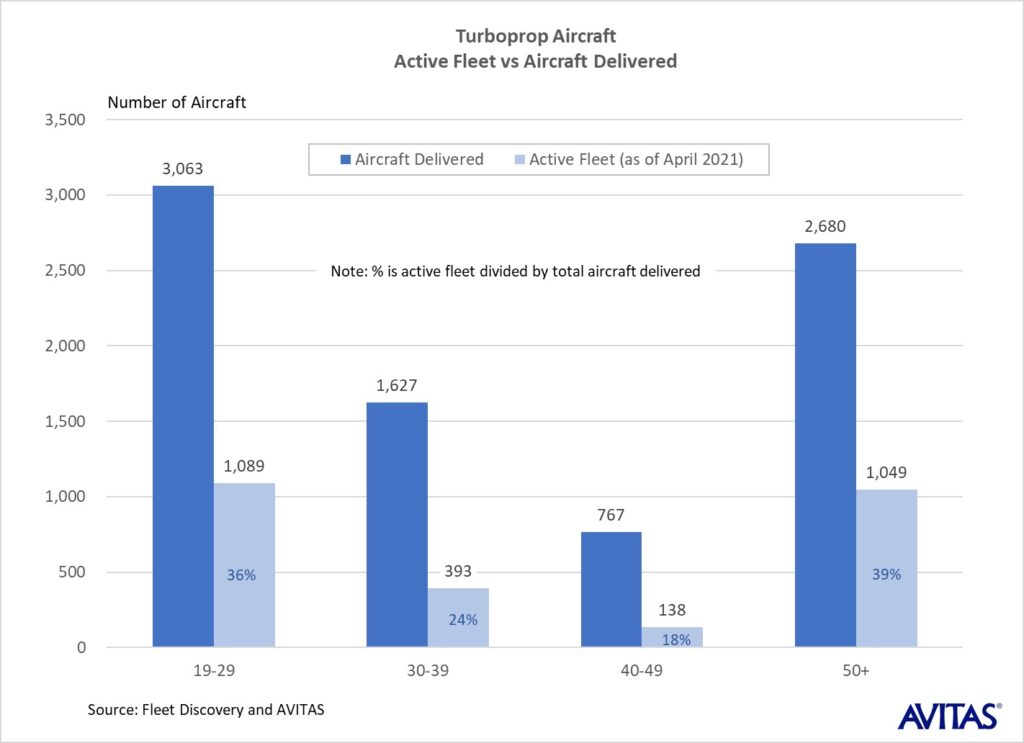

“The number of 19-49 seat turboprop aircraft currently in service has declined dramatically from the total produced and delivered (see Figure 2). Over the last 20 years, the number of active aircraft has declined about 40%,” he adds.

“The outlook for the next ten years is for the fleet to shrink further with greater retirements than new deliveries. AVITAS estimates that the total fleet size in the 19-49 seat category will decrease about 20% from 1,620 to 1,296.

“The only manufacturers that remain active in the 19-49 seat space are ATR with the ATR 42-600 (48 seats) and Viking Air with the DHC-6 Series 400 Twin Otter (19 seats). Indonesian aircraft manufacturer, PT Dirgantara Indonesia (PTDI) plans to produce its 19 seat N219 twin engine turboprop at a rate of four per year by 2024,” Kelly remarks.

Alton Aviation Consultancy, managing director Adam Guthorn, includes aircraft smaller than 19 seats in his market assessment. “The current fleet of Western built, sub-50 seat turboprops and regional jets comprises nearly 1,900 aircraft in active service today. With nearly all types having ceased production, the fleet will gradually decline through retirements over the next decade to reach 1,200 aircraft in service by 2031,” he forecasts.

Deutsche Aviation is aiming to fill the space between the Twin Otter Series 400 and the ATR 42 with a return to the market of the Dornier 328, in particular a new model – the D328eco – which the company aims to bring into service by 2025. Upgraded avionics and a sustainable aviation fuel (SAF)-compatible PW127S engine are among the new features.

According to Jose Costas, vice-president – sales and marketing at Deutsche Aircraft, approximately one-third of airports in the world are served exclusively by turboprops and will offer an ideal opportunity for an aircraft such as the D328eco.

“The sub-50 seat market has almost 4,000 aging aircraft (with average age above 25 years) and 80% of all of these are not in production anymore. There is also a large number of 50-seat RJs aging and without replacement options,” Costas observes. “But with Deutsche Aircraft benefitting from the global expertise of 328 Support Services, we are still here and are able to provide global support – through parts, services and training – to our customers and their aircraft, which have accumulated over 4 million flight hours.”

For out-of-production types, there is the question of how long they can continue under current maintenance practices and parts availability. “Although an aircraft’s structural life is indefinite (as long as it is maintained properly), its economic life ends when it can no longer generate a positive discounted cash flow (in other words, it is cheaper to replace or scrap the aircraft than to continue maintaining it),” explains AVITAS’s Kelly. “Generally, we think of the economic life of a passenger jet aircraft to be 20-30 years with freighters 7-10 years longer. The average age at retirement for passenger turboprops has increased from 22 years in the 1990s to an average of 26 years during the last 10 years (2010 to 2020).

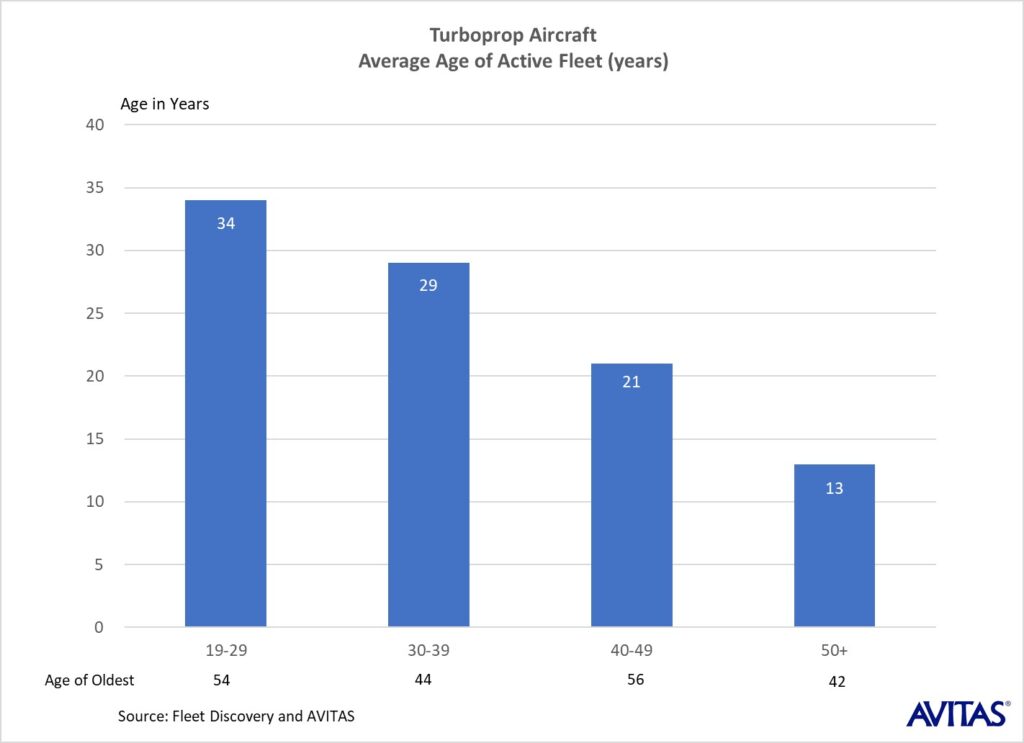

“We expect the average age of turboprop retirements to increase over the next few years, due to the lack of efficient new aircraft to replace the current fleet and high average age of the fleet (see Figure 3),” the SVP comments, while noting, too, that “many aircraft in this size segment serve remote locations with challenging geographical and/or aircraft conditions so replacement by larger turboprop or jet aircraft may not be feasible”.

Investment in upgrades is one way to extend service life, of course, and with increasing digitalisation of the industry, there are technologies emerging that could help, such as making spare parts available via 3-D printing/additive manufacturing.

“The pressure to reduce carbon emissions in aircraft is driving change in the aviation industry. The development of technology to reduce emissions begins with smaller size aircraft,” Kelly emphasises. “Technological innovations in electric power and 3-D printing could transform the small regional aircraft market. The airframe and engine OEMs are all working on electric versions. The goal is to start small and eventually move into developing a family of larger size and longer-range turboprops.

“Additive manufacturing or 3-D printing is a technology that may transform how aircraft are built and maintained in the future. GE’s Catalyst Engine is the first clean-sheet engine for the turboprop market in more than 50 years,” Kelly reports. “It is the first turboprop engine built with 3-D printed components and is targeted to power the nine-seat Cessna Denali. Producing parts with 3-D printing can reduce manufacturing costs by 35% or more while reducing weight, wear, and leakage.”

Alton’s Guthorn points to the “robust network of aftermarket service providers – independent and OEM authorised facilities – which exists to support the continued airworthiness of the fleets” as a key asset in helping existing types to continue their operational lives.

“With limited replacement options available and demand for cargo and other non-passenger operations, sub-50 seat aircraft should remain in service as long as their continued operations are economically viable,” he confirms. “Retirements and part-outs of aging aircraft will provide parts supply to the remaining in-service fleet in addition to parts available from OEMs and PMA parts suppliers. Further, some aircraft OEMs have developed extended life programmes which increase the maximum flight hours and cycles that an airframe can accumulate, allowing for continued operation under appropriate maintenance practices.”

As for help from upgrades and digitalisation, Alton director Joshua Ng adds to the point that as these aircraft have ceased production, strong aftermarket support is crucial to extending their service life. “Supporting low volume parts through 3-D printing initiatives could be an option for these aircraft,” he says. “With the drawings on hand, any certified 3-D printing shop with the requisite CAA licences can produce a form-fit-function equivalent part, thereby avoiding the need to wait for long lead-time parts.

“Another aspect that could help prolong the service life of these aircraft is through the electrification of the propulsion systems. As aviation embraces environmental sustainability initiatives and attempts to become carbon neutral by 2050, electrification can help reduce CO2 and other greenhouse gas (GHG) emissions,” Ng states.

“The question of whether aircraft can be electrified with engines such as those currently in development (for example, the magni350 and magni650 electric propulsion units from magniX) is a matter of economics. OEMs or potential STC holders will have to weigh the cost of the non-recurrent engineering work with the benefits that could be obtained through selling these conversion fleets,” Ng muses. “As such, aircraft models with large in-service fleets, and incumbent operators willing to underwrite the development expense, will have a higher chance of success. A host of new e-CTOL aircraft in development – such as the Dante DAX-19, Heart Aerospace ES-19, Bye Aerospace eFlyer, VoltAero Cassio and others – with their clean-sheet electric-first aircraft designs, will also be vying for market share in the sub 50-seat aircraft market space.”

Such a discussion begs the question of a current OEM as to how they expect the market to develop and at what point would development of a new type be warranted and would it involve a hybrid or fully electric powerplant.

“With policymakers expected to limit the potential of carbon emitting fuels increasingly, pressuring companies to offer quicker solutions towards clean technologies transition – and due to their already lowest environment footprint – turboprop aircraft will lead aviation towards the climate goal,” Deutsche Aviation’s Costas avers.

“The D328 platform is therefore the perfect aircraft to support the environmental transition. It is small enough to be a practical technology testbed, yet large enough to have commercial utility and viability with the improvements and future technologies,” he adds as he makes his case. “As a first step, the 328eco will cater for the SAF requirements of the market, but we will then be using the D328 platform to push on the development of new technologies in the long run. Recently, Deutsche Aircraft announced a long-term partnership with H2FLY to work on a hydrogen powered Dornier 328 demonstrator aircraft, expected by end of 2025.”

Doug Kelly picks up on the powerplant developments which could ‘electrify’ current turboprops as well as powering new types. “magniX is producing electric propulsion systems for all-new aircraft such as the Eviation Alice and to retrofit existing aircraft such as the de Havilland Beaver and 208B Cessna Grand Caravan [which have already flown with magniX engines]. Developing more powerful systems to handle 19 seaters like the Twin Otter or Beech 1900 would seem to be a logical next step,” he observes.

“ZeroAvia is working on their own 19-seat hydrogen-electric aircraft by utilising the Dornier 228 aircraft. They have also secured funding for the development of a 50+ seat engine development programme.

“Some airlines are showing their willingness to promote responsible and sustainable aviation by placing orders on these new aircraft that are still years away from being certified for commercial operation,” Kelly notes. “In March, Finnair placed an order for 20 electric-engined ES-19s from Heart Aerospace.”

That deal was followed in July 2021 by United Airlines Ventures (UAV), Breakthrough Energy Ventures (BEV) and Mesa Airlines, announcing their investment in – and commitment to – the ES-19. This 19-seat electric aircraft is being designed to fly routes of up to 250 miles.

Alongside its investment vehicle’s involvement, United Airlines conditionally agreed to buy 100 ES-19s once the aircraft meet airline’s safety, business and operating requirements. Mesa Airlines also committed to acquire 100 ES-19s, subject to similar requirements.

With endorsements such as this, the long-term outlook for the sub-50 seat market is improving, although bringing some of the greener technology to the upper end of that capacity range will come later.

“Continued collaboration across industries is necessary to achieve carbon-neutral flying by 2050. The industry has a long way to go before meeting that goal; however, the first steps have been taken in developing new electric and hydrogen aircraft for the sub-50 seat market,” Kelly declares in summary.

Author: Bernie Baldwin

Published: 10th August 2021

Join the challenge

Do you believe the development of the new greener aircraft for the sub-50 seat plane market should be given higher prioritisation amongst manufacturers? We’d love to hear your thoughts on this…